India New Income Tax Slab 2025, Income Tax Slab for 2025-26

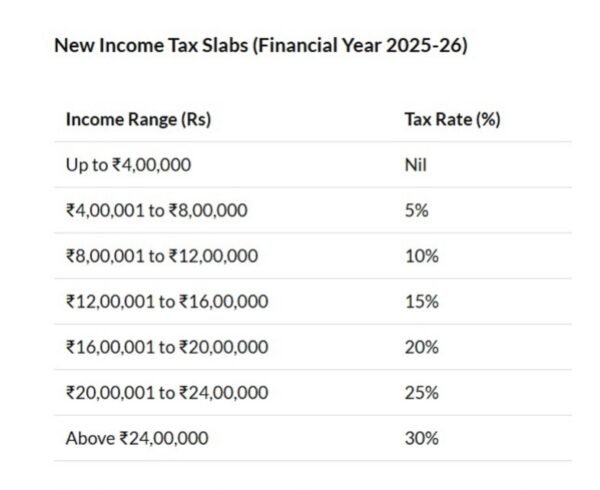

The income tax slabs for the financial year 2025-26 have been revised under the new tax regime as announced in the Union Budget 2025. Here are the key details:

New Income Tax Slabs (Financial Year 2025-26)

| Income Range (Rs) | Tax Rate (%) |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 to ₹8,00,000 | 5% |

| ₹8,00,001 to ₹12,00,000 | 10% |

| ₹12,00,001 to ₹16,00,000 | 15% |

| ₹16,00,001 to ₹20,00,000 | 20% |

| ₹20,00,001 to ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

For salaried taxpayers, this limit extends to ₹12.75 lakh due to a standard deduction of ₹75,000.

Standard Deduction: The standard deduction has been increased to ₹75,000 for salaried individuals.

This restructuring aims to alleviate the tax burden on middle-class taxpayers while encouraging higher disposable incomes.

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, introduced significant changes to the income tax slabs under the new tax regime. The revised income tax structure aims to provide substantial relief to taxpayers, particularly benefiting the middle class.

New Income Tax Slabs for FY 2025-26

The updated income tax slabs are as follows:

- Up to Rs 4 lakh: 0% (No tax)

- Rs 4 lakh – Rs 8 lakh: 5%

- Rs 8 lakh – Rs 12 lakh: 10%

- Rs 12 lakh – Rs 16 lakh: 15%

- Rs 16 lakh – Rs 20 lakh: 20%

- Rs 20 lakh – Rs 24 lakh: 25%

- Above Rs 24 lakh: 30%

Notably, individuals earning up to Rs 12 lakh will not have any tax liability due to a tax rebate and the standard deduction of Rs 75,000 for salaried individuals, effectively raising the threshold for tax exemption to Rs 12.75 lakh.

Tax Benefits and Examples

The government has emphasized that these changes will significantly reduce the tax burden for many. For instance:

- A taxpayer with an income of Rs 12 lakh will save approximately Rs 80,000 in taxes.

- An individual earning Rs 18 lakh could see a tax benefit of around Rs 70,000.

- For those with an income of Rs 25 lakh, the benefit could reach up to Rs 1,10,000.

These adjustments reflect a broader strategy aimed at increasing disposable income for middle-class families and stimulating economic growth through enhanced household spending and investment potential. The changes also mark a continuation of the government’s efforts to progressively raise the basic exemption limit over recent years